Índice de contenidos

ToggleReal case of tax savings via constitution of a holding structure

- 1 nov 2020

- 2 Min. de lectura

Actualizado: 10 may 2021

The incorporation of a holding company structure does not only achieve an organizational solution at the lowest fiscal cost, but it is also a very convenient feature for the entrepreneur. Here we talk about a real case.

Real case for the incorporation of a holding structure

The project may be splitted into three phases: study of needs, proposal of a solution, in this specific case it is the holding structure, and follow-up.

Needs

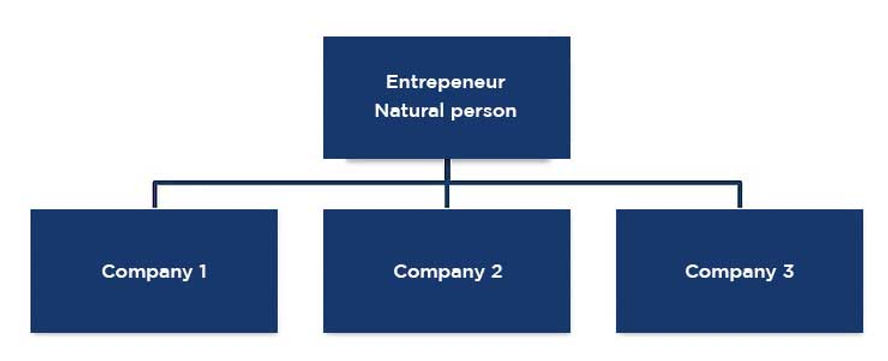

A businessman who owns several companies of linear structure seeks for our advise by exposing queries related to subsidies and exemption on Equity Tax and Inheritance Tax. The generational relay and inheritance of business towards his children makes him feel concerned.

Moreover he wants to restrict responsibility to himself, besides being able to finance other companies, or to create new ones using the benefits or the economic capacity of another company that he owns.

The entrepreneur is obviously looking for an organizational solution at the lowest possible tax cost that allows:

-

Profit from tax breaks and exemptions.

-

Generational replacement.

-

Limit the responsibility of the entrepreneur.

-

Financing and business growth.

Solution

After a thorough analysis of his business structure, his personal and family situation, but also considering the applicable tax and commercial legislation, we propose the creation of a holding structure, allowing the entrepreneur to concentrate all his shares in a single commercial «Holding», whereas this holding company is in turn the one that holds the shares of the linked or active companies.

In this way, the owner achieves an organizational structure offering the following synergies:

-

Cost savings for all his companies.

-

Consolidation of direction, management and administration within one single company.

-

Merge of shares on purpose of inheritance.

-

Achievement of rebates on inheritance tax and equity tax for all companies.

-

Separation of risk from his personal assets.

-

Resolution of problems related to inheritance and generational change.

In addition to the earlier mentioned topics, there is also a possibility for the Holding Company to open new corporations: using the profits gained by the other companies whilst distribution of dividends, which are tax-free when executed by the Holding, is a decisive advantage.

And most importantly, the research carried out by our professionals allowed the entire reorganization to be implemented at a fiscal cost of 0 €.

Follow-up

Nowadays, we do execute a continuous monitoring and advising of the entity, in the aim of making sure that an accurate performance of the new organizational Holding structure is guaranteed.

At Carrillo Asesores we support the client during the whole process of incorporation and management of the . Contact us freely for any additional information.